Greek startups still going strong against the odds

It was the best of times, it was the worst of times. Charles Dickens’ popular opening line from ‘A Tale of Two Cities’ is a pretty apt description of 2017 for Greek startups.

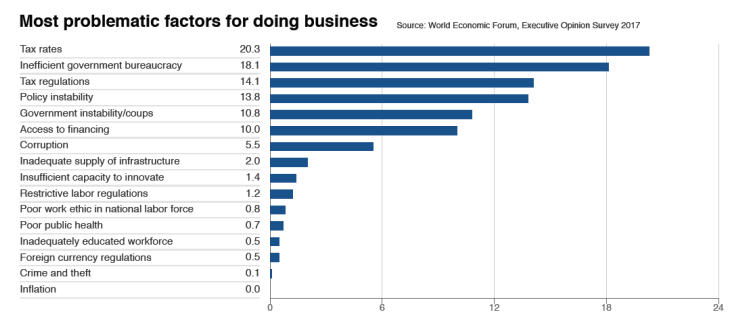

So what if there’s a seemingly never-ending financial crisis? So what if there’s a lumbering government putting up barriers like high taxes [seemingly on purpose], regulations and bureaucracy in the way of entrepreneurs and budding self-employed businessmen. It just doesn’t seem to matter. Greek startups continue to prove they can beat the odds and thrive.

Greek startups: an end of year report of sorts

Yes, this is a deliberate declaration of optimism. Because you can’t keep Greek startups down. The proof of the pudding? Look no further than this year’s highlights as detailed in Found.ation’s comprehensive report. The two largest exits in Greek startup history, that of Taxibeat by Intelligent Apps of the German Daimler Group for 40.48 million EUR, and Innoetics by Samsung for an estimated 30-40 million EUR.

If that’s not evidence of a blossoming entrepreneurial ecosystem then I don’t know what is. For further indicators you only have to look at the amount of capital that is getting put into the country. In addition, the tech startup community continues to produce an explosion of conferences, competitions, funding processes, and events. All which help to turn it into a promising and dynamic piece of the Greek economic scene.

Transitional phase

Arguably, the successes of 2017 are largely down to the funding which has come Greece’s way as part of the EU’s JEREMIE program. From 2013 to 2016, more than EUR 50 million has been invested in 60 companies. The money is not going to end here, of course. And that’s why 2017 is a transitional year.

But here we should not underestimate the determination of Greek founders. Yes, money has come in, but it is credit to businesses which have managed to flourish in spite of the state’s inability to eliminate its bureaucracy and processes. Or its ability to create the necessary tax incentives and the like to turn a country with relatively cheap labor and ideally located to be a South East European hub for tech startups.

Enter EquiFund

In 2018 and beyond it’s a case of goodbye JEREMIE, hello EquiFund. The new EUR 260m Fund-of-Funds program in Greece was launched on 22 December 2016. Managed by the EIF, it aims to boost entrepreneurship and create a lasting impact on local businesses. How? By attracting private funding to all investment stages of the local equity market, ranging from entrepreneurship steps even before the early stage start-ups, and right up to mature expansion companies.

This is the life after JEREMIE aspect where VC is concerned. Under the new program, the EIF is looking to invest in private-sector led, market-driven Venture Capital and Private Equity fund managers across Europe, focusing onto Greek companies. The new ESIF Fund-of-Funds will support technology transfer funds in Greece and will also kick-start investments into accelerator funds. The Greek Ministry of Economy and Development has set a goal of total leverage up to €1bn with the help of private investors.

From my perspective, we can only hope that those managing these funds can seize this huge opportunity to keep the momentum going. Capital efficiency – a central cog to our philosophy at Starttech – must be the watchword. If not, then it could well be a huge opportunity lost.

The oxymoron of Greece’s startup ecosystem

What makes for interesting reading in Found.ation’s report are the problems startups face, in terms of taxation, bureaucracy and regulations. Those ‘barriers to business’. In the graph below you can see the results from an executive opinion survey by the World Economic Forum. Clearly they point to high tax rates and regulations, inefficient government bureaucracy, and policy instability. These are closely followed by limited access to financing, and government instability. This puts into perspective just how determined the country’s entrepreneurs and startup founders are.

Interestingly, Greece is 1st in Tertiary Education Enrollment rate and 10th in Availability of Scientists and Engineers. This reinforces the message that there is top talent here – as well as in the greater East Mediterraean area where we focus our energies.

Another reference point worth noting comes from the European Digital City Index (EDCi). In a 2016 report, Athens ranks a poor 56th among 60 cities. It has particularly low scores for digital infrastructure, entrepreneurial culture and market conditions. Thankfully, this is changing – and fast.

Also, in terms of access to capital, Athens ranks down in 53rd place (and in 60th when it comes to early stage financing). Another interesting parameter in the same report is that Athens ranks around the same position for mentoring and managerial assistance. This reinforces our view that there is a huge gap here. A similar report, focusing on European acceleration programs, by Gust in 2015, puts Greece at the bottom of the list.

The Long Term Accelerator program

This is where we at Starttech Ventures come in. Efforts are already being made to address both of the latter issues. And it’s in these two areas (in addition to early stage capital), where our newly-developed Long Term Accelerator program is coming into its own. We aim to lead the “revolution” and help Greece climb that table. It’s our “proof of concept”, if you like. The only way is up!

Here’s to an entrepreneurship explosion in 2018

As far as I’m concerned, 2017 will go down as another great year for entrepreneurship in Greece. Reflecting on the last 12 months and seeing the way the local startup ecosystem continues to develop after another year in the time of financial crisis, it’s with great pride that I can say that.

So let’s say “Bah, humbug!” to pessimism, and raise a glass to optimism, and more importantly, innovation.

Happy Holidays.