Greek VCs and disruptive startups

What industries do Greek VCs invest in? What makes a promising startup attractive to investors? And how important is disruption? These were some of the questions that have been discussed during the last StartupNow Forum that took place Wednesday October 23 at Technopolis, Athens Greece.

Our participation at StartupNow Forum

Our Founder, Dimitris Tsingos was there and had a debating conversation with two representatives of the leading Greek VCs. In particular, with Christos Gasteratos, analyst at Marathon VC and George Dimopoulos, partner at Venture Friends, were the other two members of a panel discussion, coordinated by Christos Kotsakas.

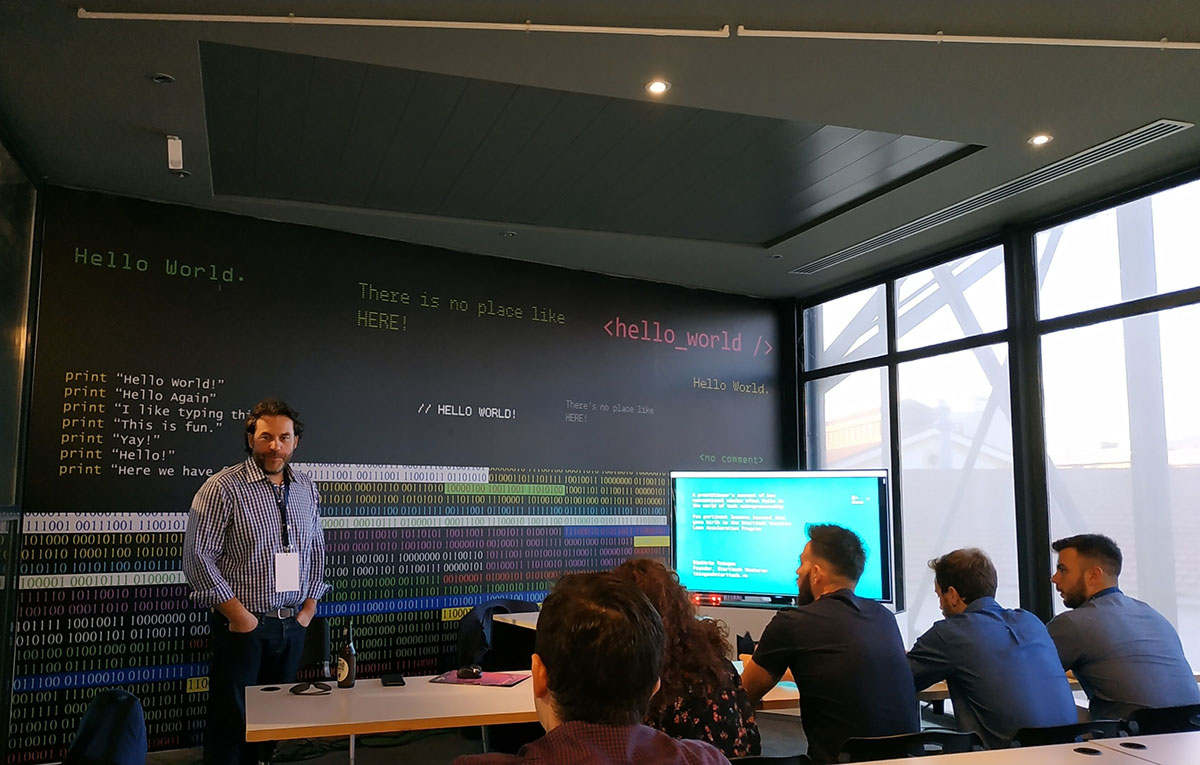

This was only the first of the two parts of our participation in this great event. With a separate parallel workshop, titled “A practitioner’s account of how conventional wisdom often fails in the world of tech entrepreneurship — Few pertinent lessons learned that gave birth to the Starttech Ventures Lean Startup Program,” our Founder Dimitris Tsingos shared with participants, as the title denotes, useful entrepreneurship lessons.

Leading Greek VCs laying cards on the table

Even though there was actually a debate between panelists, the truth is our intention. And all of our efforts are only supportive towards the Greek startup ecosystem in total.

In supporting this, we’ve invited representatives from both of the panel group members’ VCs, at our Friday Q&As. Specifically, Panos Papadopoulos from Marathon VC shared a lot of insights with us, based on his experience on VC money and the way startups see it in our of our Q&As. Likewise, Apostolos Apostolakis from Venture Friends gave an interesting presentation, regarding his perception of the Greek startup ecosystem’s current state and future opportunities. Both of them shared their pearls of wisdom, as they collected them throughout the years of their involvement in the VC arena. By that same token, Alexandra Choli from Metavallon VC explained all the secrets startup founders need be aware of when pitching investors. And on our part, we were more than grateful to have these great conversations, and see things from their perspective, as it happens with all of our guest speakers.

For the moment, in order to keep you updated regarding this interesting discussion, let’s get into some more details. First, let us introduce the topic of the discussion: “Disruption is an on-going, long-term, global megatrend…in what industries do Greek VCs invest in?” The majority of the questions were focused on that concept.

Investment Criteria: How Greek VCs filter candidate companies

The first question was about major selection criteria VCs focus on, to filter their investments. And that’s were Dimitris Tsingos explained our investment framework Minimum Viable Investment Framework. “We are a private investor — since we’re investing our own money — and our investment strategy focuses exclusively in B2B, SaaS companies that have automation implemented in all levels and target market North US. These are our investment criteria. And since we’re an early stage investor, we want to be the 1st investor after 3Fs (friends, family and fools).”

But what about the other two representatives? Well, both of them agreed that a great team with a great product, targeting a bigger market is, without a doubt, among their top candidates. But this market should be a growing one.

Specifically, G. Dimopoulos, Venture Friends’ representative, emphasized the fact that teams, in order to be accepted, should have no missing key skill-set. And a scalable business model is, of course, indispensable.

Similarly, Christos Gasteratos mentioned that: “The initial team of let’s say 5 to 10 people will, somehow, show you whether this company will grow into one of 10 million or 100 million or 1 billion dollars company. The team is a key indicator of the qualities of the company that will be created.”

The role of disruption: Do you really need to be disruptive?

On a relevant question on what disruption is and how important it is, even though each panelist gave their own definition, they all agreed that disruption is a key element for success. So, what does disruption mean to these three leading Greek VCs?

Disruption can be anything

G. Dimopoulos said that “Disruption, at least the way we approach it, is when a technology “enters” a market offering a pioneering and groundbreaking technology”. He continued to explain the example of Beat, who managed to introduce a new element in the established taxi cab market: “They enabled passengers to hold drivers accountable. That’s what they did.” And added: “Disruption can be anything. And the way the market receives each new element, defines the disruption in the end. It could be offering a service in much better way than it is already being offered.”

Disruption: an overloaded concept

For Starttech Ventures “disruption is a term that has been way too overloaded” as Dimitris explained. “We are not interested in investing in disruptive startups. And though we may say it in a kind of provocative way, the truth is that we do mean it. Disruption has a risk factor that we, as private investors, cannot take. And that’s only with regard to disruption, in terms of technology. That is, we won’t get involved in Machine Learning, in Blockchain, in AI or in Quantum Computing. We’ll take the safe path, focusing on markets that already exist.”

The truth is, we attach disruption a different meaning, and Dimitris explained this one with Epignosis’ example: “The most successful company in our portfolio is Epignosis, which is actually an LMS platform.” In the beginning, the feedback we managed to get, when introducing it to new investors abroad (in the US and in West Europe) they used to give us the same answer. “There were too many LMSplatforms. And our solution was another LMS among hundreds of others.” And, of course, they were absolutely right!

“But they missed the fact that Epignosis, or a company that combines three basic ingredients, in general: a) a complete feature set, b) an exceptional emphasis on ease-of-use and c) a disruptive pricing model, finally makes the difference.” And that’s what made Epignosis successful.

Disruption is not a one-way street

Marathon VC’s representative, Christos Gasteratos, also talked about the “risk” aspect of disruption. “You enter a new market, for example with a company that develops a new technology and the final product is kind of elusive, which definitely increases the risk.” And continued to explain the choices they make in order to minimize such risk. In particular, Marathon VC focuses on two types of disruption a) either you introduce a new technology that creates a new market “But that requires to have an in-depth technology background”, as Christos Gasteratos explained or b) you create new features that offer a new functionality in an existing market and explained this one with Slack example “Slack, apart from instant messaging that was already out there, also created functionality for enterprise companies, by integrating add-ons of other essential services for businesses. It managed to offer a fully functional, instant messaging solution to customers.”

The debating part: When VCs caution you regarding fundraising efforts

When panelists were asked to give a few core characteristics that startups need to have in order to attract investors Dimitris gave a provocative answer that (kind of) raised a debate. So, read on for the juicy part 🙂

No one offers you money for free

“With the greatest of respect, this question is the wrong question. From time to time, we’ve seen entrepreneurs celebrating for having raised a huge amount of money. But celebrating for getting funding, is as if you’re celebrating for getting a loan.”

As Dimitris explained, when you get funding, you’re giving away a part of your company, in exchange for money. “No one offers you money for free.” and continued: “I’m not against funding, what I’m trying to say is that you should get funding for the right reasons. As an angel investor and early stage investor, I’ll choose a team that will explain, in detail, how they’re going to create real value in a global market, with a scalable model. The ‘economic’ success, will come as a reward of the real value this company managed to create. At Starttech Ventures, we choose those that are ready to work hard, in order to succeed. At the end of the day, a huge round is not an indicator for success. Offering real value to the market is what makes a difference. And that requires a team that definitely has skin in the game.”

Dimitris continued to explain that he didn’t mean to ‘anathematize’ VCs. VCs, on their part, invest in a number of companies; but only a portion of them gets huge returns in the end. “Some of them will succeed and some will fail. But, for entrepreneurs, it’s a binary state. That’s why founders should be fully prepared.”

Don’t do fundraising for the sake of fundraising

Venture Friends’ representative, George Dimopoulos, though he disagreed with Dimitris’ kind of witty remark, he agreed on the erroneous funding part: “Don’t do fundraising for the sake of fundraising”. VC’s do not only focus on providing startups with money. They also help startups solve fundamental problems they’ll face on their way to success. As George explained: “It’s not just funding it’s also consulting and knowledge sharing. VCs offer consulting, help you network with other founders that ‘been there’ and other investors.”

Funding is not a prerequisite for success

In the same way, Marathon VC’s ambassador, Christos Gasteratos added: “Funding is not a prerequisite for success. Money will help you grow further, and that should be your effort. You need the money in order to make operations ten times better.”

So, if you’re a startup trying to get funding, here are a few tips to keep in mind.

Key take-aways: pieces of advice from Greek VCs

- Get as much feedback as you can. Filter that feedback, make a well-structured plan and focus on how you’ll develop your company further. (Marathon VC)

- Make sure you have matching profiles with your investors. Startups need to be very careful in their collaborations; and more specifically when they select their investors. (Starttech Ventures)

- Choose investors that won’t offer you only funding. Make sure that, apart from money, they’ll also be there to offer their full support and help you move forward. If not, then you’ve chosen the wrong investors. (Venture Friends)