Our Blog

Our blog is a hub for educational content about startups and scaleups, designed to empower entrepreneurs with valuable insights and practical knowledge.

Written by our team of experts, the articles cover a wide range of topics, drawing from their unique specialties and experiences.

You’ll also find updates on our latest activities as a company, providing a behind-the-scenes look at what drives us at Starttech Ventures. Whether you’re an aspiring entrepreneur or a seasoned professional, our blog offers inspiration and guidance for your growth journey.

Latest Blog

A Toast to Knowledge: My Journey Through Wine Tasting with Ted

There are experiences that stick with you, like a well-aged wine. So here I am, pouring two words (or maybe a few more) about the unforgettable wine-tasting journey at Starttech Ventures with the one and only Ted Lelekas.If someone had told me a few weeks ago that I’d be spending my evenings swirling glasses, sniffing […]

Articles

Attending the #Oneof11 Event by Eleven: Key Insights and Takeaways

Recently, I had the pleasure of attending an inspiring event hosted by Eleven Ventures.” The evening was a celebration of the entrepreneurial ecosystem that Eleven has built over the past eleven years, and it provided a fascinating look at both the successes and challenges that have shaped the community.

Entrepreneurship as a Catalyst for Positive Change

The profit motive, or the drive to make earnings from business activity, is ultimately, the driving force of capitalism, creating a competitive environment. However, entrepreneurs within this system are not always solely driven by the profit motive – entrepreneurs provide the creative force capitalism (free enterprise) needs to work.

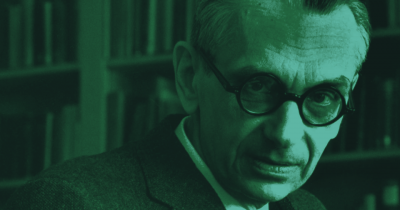

Gödel’s Two Theorems: the Completeness Theorem and the Incompleteness Theorem.

We are delighted to host a two-hour lecture on the topic of “Τα δύο θεωρήματα του Gödel: το θ. πληρότητας και το θ. μη-πληρότητας” (Gödel’s Two Theorems: the Completeness Theorem and the Incompleteness Theorem) on June 11th from 17:00 to 19:00 in the multi-use space on the 2nd floor.

Artificial Intelligence: Impact on the workplace

Starttech Ventures proudly hosts two lectures of Mr. Georgios Georgakopoulos, Professor of Computer Science at the University of Crete in June, on Tuesday June 4th and Tuesday June 11th respectively

Stay Away: self-defense seminar

Starttech Ventures along with Epignosis took a meaningful step during the 16 days of activism against gender-based violence, commencing on November 25th, the International Day for the Elimination of Violence against Women

Development and Quality – The New Alliance New National Developmental Education Policy

Starttech Ventures is excited to host a series of comprehensive workshops with Michalis Charalampidis a Greek politician, sociologist and author. Starting from Tuesday, October 3, 2023, at 18:00

12 + 1 Aspects of Natural Intelligence.

The article presented here was the result of a Starttech internal discussion on AI issues. It was translated by the author, Prof. Georgakopoulos, with some minor editing, from the Greek prototype.

Opportunities to work in Greece – 2nd webinar by Starttech Ventures

Season’s greetings! In case you missed it, a few weeks ago we ran the 2nd webinar of our latest initiative. “Work in Greece” is an open call for talented people from all over the world, interested in working at one of our tech startups. What we’re trying to achieve with this strategic decision is build […]

The Eleven Alpha investment is out!

Our good friends at Eleven Ventures just rolled out their brand new investment program, named Eleven Alpha! Find out how it works and how you can become a part of it, by November 19th, 2022.